Kids will need to start counting money sooner than later. While saving and investing for your child’s future is important, its also important to teach your kids about money. Prepare your child for real life money situations, promote money management skills and cover concepts such as tax and interest.

Teach Children Financial Responsibility

There’s no age limit for helping your kids learn to manage money. Here are top tips to teach your children financial responsibility.

GET INSTANT HELP FROM EXPERTS!

- Looking for any kind of help on your academic work (essay, assignment, project)?

- Want us to review, proofread or tidy up your work?

- Want a helping hand so that you can focus on the more important tasks?

Hire us as project guide/assistant. Contact us for more information

Teach them to budget

An allowance can be a great first step in showing your kids how to manage money.

You may give money:

- Every week to the youngest children

- At two week intervals for preteens

- >Monthly for teenagers.

Gradually spreading out the timing will help your children understand the need to manage their spending.

If your child spends the entire allowance right away, avoid giving them more money before their next allowance is due. Talk to your kids about how to do better the next time so they can make better choices.

Show them the value of saving

Let kids discover the benefits of delayed gratification. If there’s something game they have their eyes on, suggest them to forgo spending their allowance on ice cream or another immediate pleasure and instead save for a few weeks to make the bigger purchase.

Let them earn a little extra

While you expect your kids to clean their room and help in other daily chores, consider offering your kids the chance to make extra money by helping you on things that go beyond the routine.

Getting paid for that extra work will help instill good habits.

Kindergarten/Elementary

Use a clear jar to save

The piggy bank is good but the child cannot see what’s inside. When you use a clear jar, they see the money growing.

Make a big deal about the growing money.

Set an example

Kids watch parents. If your trips to the restaurant or to the grocery store if frequent, they will notice. But if, at the end of every month, you and your spouse are arguing about money, they’ll notice.

Set a healthy example for the kids.

Show them things costs money

Instead of saying “That pack of toy cars costs Rs.500”. Let them take out the money from the money jar, and physically hand the money to the cashier at the take store.

This simple action will do more than any lecture.

Tweens (between 10 and 12 years)

Make them understand “Opportunity Cost”

Opportunity cost simply means “If you buy this video game, then you won’t have the money to buy that pair of shoes”.

At this age, make your kids understand that each decision has a consequence and they should be able to weigh decisions.

Money is earned and not just given

At this age, don’t just give your kids money. Pay them money based on chores such as cleaning their room, disposing of unwanted things, taking out the trash.

Help them understand that money has to be earned.

Teenagers

Let them manage a bank account

By letting your child manage a simple bank account at this age, you can help significantly improve their money management. Hopefully, it will also prepare them to manage a much heftier account balance when they get older.

“Help” them find a job

Teenagers have plenty of free time during holiday breaks.

Help them find a small job and earn some money. Let them experience that working can be a great way to make money.

Dangers of Credit Card and Risky Investments

When your kids start going to college, they will also start receiving sales calls for credit card salesmen.

Teach them the danger of using credit cards and make them understand why debt can be a bad idea. Don’t let them become another credit card victim.

Let Young Earners Make Their Own Financial Decisions

Anxious parents are always eager to give financial advice to their kids to handle money, especially if your child has just started earning money.

Don’t borrow. Don’t overuse the credit card. Don’t spend unnecessarily on clothes, smartphones, parties. Start an SIP. Invest in stocks. Save more.

However, its best that you let first-time earners make their own financial decisions and not force them into making any financial commitments (for a few years), so that they can learn from their mistakes.

Here are some suggestions for parents:

-

Give young earners time to gain experience on use of money. Let them deal with consequences of their action, so they learn from the experiences of spending money. Those lessons last longer than most parental advice.

-

The first five years of career is important as it gives young people the opportunity to understand what they really want todo. Many choices of education are still made under pressure from parents. So avoid burdening them with EMIs such as house loan, at least for the first five years.

-

Avoid chaining them with emotional blackmail while they seek to build their competencies and stabilize their incomes.

-

One big personal finance challenge for the young earner is to manage cash flows. They need to learn over time to find the balance between cash and credit, spend and save, accumulate and withdraw.

-

Saving is a good habit but it needs to be cultivated. Give your children the time to see the merits of making sacrifices that are needed to develop a steady saving habit.

If there is a shared future goal (something that the child can also relate to), working towards it becomes worthwhile. It could be building a corpus for a goal like higher education, housing, or even entrepreneurship.

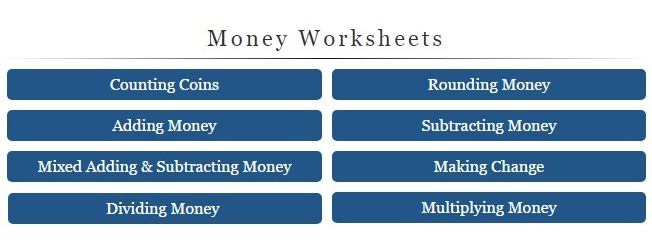

Money Worksheets

Use these worksheets to help children to count and recognize different money from countries around the world. You can even produce your own money worksheets using coins, bills, or both.

Money Management Games

Here are some excellent games that will teach your kids about money, some of these are really unique and will help your child learn more about business and entrepreneurship.

The best one is Monopoly Electronic Banking Game from Hasbro. Your child will learn to collect rent, buy property, pay fines, using bank cards, and a clever electronic unit that mimics a real card reader device.

ATM and cash register toys

Learn money management and saving skills with these toys. This ATM toy is the best one to teach children about money management skills.

This one is a sophisticated toy that displays the amount on the screen when kids deposit real coins and bills in the ATM. The toy even comes with an ATM card and a pin allowing kids to check their account balance, make deposits, and withdraw funds.

Money banks/piggy banks

The art of saving is dying, with many people today living beyond their means, because of which many face financial problems later on.

It’s important for kids to learn to start saving right from an early age, and it’s important that parents inculcate this good habit in kids.

These piggy banks are the perfect tool for doing that.

As a child, my parents would give me spare coins and small currencies (notes) to put in my piggy bank. Every few months, I would open the piggy bank to see how much I had collected, and my parents would buy me a nice gift (a toy) using that money.

I would then repeat the process.

My parents were obviously happy with my saving habit, and I feel that every parent should try to inculcate this habit in their child.

Pretend and Play Money for Kids

Financial education is a must for children nowadays. Now you can teach kids the basics of money using these games.

Play money sets to introduce useful money skills to kids, to help them recognize the various notes and coins. These dummy currency notes are available in various denominations; you get the notes as well as coins.

You can use these to teach simple math – addition, subtraction and counting skills to kids.

When buying play money for kids, it is better if you buy something that comes with some sort of storage so that the money can be kept neatly inside the box/storage. Buy on Amazon.

The next time you go shopping, let your child hand money to the cashier and also ask them how much they are going to get back in return.

Creative Craft Work (Funny)

While most kids love to draw on walls, this little one have used photos of Mahatma Gandhi from 500 rupee notes for her drawing homework (Gandhi Jayanti on 2nd October).

And mind you, these 500 rupee notes are not the old ones that were in circulation before demonetization. These are the new 500 rupee notes.

Useful Links

Use three jars – “Spend”, “Save” or “Give” – to teach useful money lessons to kids

Leave a Reply